Identity and State Capacity: Religious Discrimination in Late-imperial Russia

by Volha Charnysh

Scholars of state capacity and ethnic politics rarely talk to each other. Yet ethnic identity plays an important role in the development of state institutions, as highlighted in a number of recent posts.[1] In a brand-new World Politics article,[2] I contribute to the scholarship on the relationship between ethnic identity and state building by highlighting that state capacity varies not only across territory but also across ethnic boundaries, which can lead to ethnic bias in the distribution of state resources in administratively weak states.

I argue that state officials face greater barriers to collecting information from ethnic outgroups, particularly when they rely on indirect rule instead of building up administrative capacity on the ground. The resulting informational asymmetries vis-à-vis indirectly-ruled ethnic outgroups, in turn, reduce the returns from supplying state resources into this population. From the perspective of state officials, supporting illegible ethnic groups is unlikely to pay off in future fiscal revenues.

I support this argument using original district-level data on famine relief, ethnic demography, and state-capacity indicators in Imperial Russia. I show that Russian Orthodox officials delayed and withheld public assistance to districts with a larger Muslim population because they lacked information about Muslim communes and could not guarantee the repayment of loans and taxes.

The fiscal logic of ethnic bias

Governments’ incentives to supply collective goods are shaped, in part, by expected fiscal payoff. Assessing and collecting taxes, in turn, depends on access to information about the population and its economic activity.

In administratively weak and ethnically heterogeneous states, informational capacity often varies with ethnic demography. As a rule, governing ethnic outgroups entails higher transaction costs. Citizens who do not share ethnic identity with the central state are less likely to comply with its fiscal demands voluntarily. At the same time, state officials are less capable of monitoring and sanctioning noncompliance among non-coethnics with whom they do not share culture or social ties.

For these reasons, states often adopt different governance strategies toward different groups. They may opt for indirect rule in regions dominated by ethnic outgroups, to save on administrative resources. While effective in the short run, reliance on ethnic intermediaries does not resolve the information problem and limits future state capacity.

I further argue that because providing benefits to illegible populations generates lower fiscal returns, state officials will discriminate against them in the allocation of public resources. The fiscal logic of ethnic discrimination is most applicable to administratively weak autocracies, which bear limited electoral costs of ignoring citizens’ needs, have limited territorial reach, and are concerned with extracting maximum revenue from their populations.

Evidence from the 1891-92 Russian famine

I support this argument using data on the distribution of state relief during the 1891-92 famine, one of the most severe agricultural crises in the nineteenth-century Russia. The government mounted an extensive relief campaign: at the height of the crisis in early 1892, nearly a third of the population in the affected region was receiving public assistance. Yet the distribution of aid was extremely uneven, and famine-induced mortality varied across districts with similar crop yields.

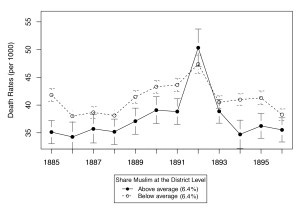

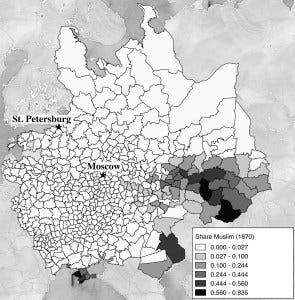

I show that religious demography influenced the generosity of the imperial government’s response to the crisis. Districts with larger Muslim population, which amounted to 2.2 million people, or 18% of the population in the Volga basin,experienced significantly higher mortality and lower natality in the famine year (see the figure below). At the same time, the relief campaign was less generous in such districts. The presence of Muslims delayed the onset of relief campaign and reduced the average size of monthly bread loans. A standard-deviation increase in the share of Muslims (15%) reduced the aggregate indicator of relief from the central government by a quarter of a standard deviation, which is twice as large as the predicted effect of the 1891 drop in yields. By contrast, the presence of other religious minorities or the share of non-Russian speakers does not appear to have influenced the distribution of relief.

Reports of zemstvos, local self-governance institutions, corroborate these statistical findings. I find that the size of food loans was sometimes explicitly tied to recipients’ ethnicity, with loans to Muslims set at half the size of loans granted to the Orthodox peasants.[3]

Religious identity and mediated governance

In the article, I link the underprovision of relief to Muslim communities to their lower legibility and taxability. Imperial Russia relied on an elaborate “religion-centered framework” to govern its “foreign” confessions. The Muslim minority, in particular, was governed with via spiritual assemblies in Orenburg and Ufa, headed by salaried muftis chosen by the tsar. The mufti would draft circulars on various issues under the direction of the imperial authorities, which were then passed to the local clerics, ulama, for circulation among their congregations. The ulama were thus the main local agents of the imperial government (see Tuna 2015).

Starting in the 1870s, the imperial government began to transition to a more direct rule and standardize tax obligations. It retained the assemblies, but intervened in their operation. In the short run, these policies undercut the assemblies’ legitimacy among the local population and made Muslims suspicious of the Orthodox officials.

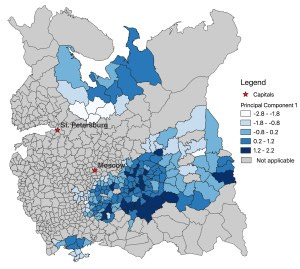

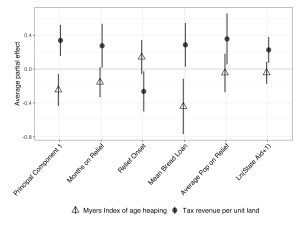

As a result, state ability to gather information and collect tax arrears was particularly low in districts with a larger Muslim population in the 1890s. I demonstrate this using the Myers Index of age heaping[4] constructed from data on ages in the 1897 Imperial census (see more detail in my earlier post on legibility) as well as direct taxes collected from peasant land before the famine. Both informational and fiscal capacity were significantly lower in districts with a larger Muslim population. Note that other identity markers, such as language, did not predict state capacity outcomes. This is consistent with the importance of confessional governance over other factors that affect state-society relations in Russian context.

The first principal component, which corresponds to the generosity of relief by the central government, is based on five indicators of relief: months on relief, average loan size, population on relief, and total state aid.

How informational capacity influenced famine relief

Lower legibility, in turn, affected Muslims’ “economic utility” from the perspective of state officials and thus the generosity of famine relief. Both age heaping and pre-famine tax receipts are robust predictors of relief indicators in regression analyses. Moreover, the negative relationship between the share of Muslims and relief indicators holds only in districts with below-average informational and fiscal capacity. Thus, the underlying state capacity rather than ethnic prejudice alone shaped the distribution of aid.

Zemstvo reports further illuminate the difficulties in gathering reliable information from Muslim communes. Inadequate information about local economies complicated tax assessment and reduced fiscal payoff. For instance, the Buguruslan zemstvo officials justified giving half-ratios to the Muslim peasants by their “huge indebtedness […] for food loans given in previous years, incorrect, universal requests for food loans at the present time, and […] the custom of eating horse meat, which is now extremely cheap.”[5] The Stavropol’ district zemstvo’s Audit Commission, pointed out that Muslims were the most recalcitrant payers despite possessing “huge, in comparison with the rest of the population, land allotments” and bemoaned having to “assist this population during poor harvests without any hope of repayment of the loans issued, which burdens the budget of the zemstvo and other taxpayers.”[6]

The fiscal rationale was also central to the response of the central government. In August 1891, a circular of the Interior Ministry (MVD) to provincial governors emphasized gathering accurate information before suspending the collection of taxes and arrears; it suggested that deferment apply only to redemption payments, but not to the regular taxes. The MVD cautioned that some communes may be able to fulfill their fiscal obligations even when the harvest fails.[7]

Broader implications

My research suggests that noncoethnics may receive fewer transfers from the state because they generate less revenue, i.e., they are not disadvantaged across all domains of distributive politics to the same extent. In Imperial Russia, state officials relied more heavily on Orthodox peasants when it came to raising taxes, whereas religious minorities sometimes got away with paying less into state coffers.

By linking information asymmetries in diverse societies to historical differences in governance institutions, I contribute to growing work that views contemporary public goods provision and ethnic heterogeneity as legacies of institutional development in the past. I also contribute to research on the institutional determinants of state responsiveness to famines and other humanitarian crises by showing that when a disaster strikes, states are less likely to assist populations whose needs are harder to verify and/or who are harder to tax.

How generalizable is this argument? Many contemporary states collect detailed information about individual citizens and have administrative tools necessary to ensure tax compliance. However, ethnic intermediaries remain powerful in the developing world, where large numbers of citizens lack direct ties to state institutions and do not participate in formal fiscal exchange. This equilibrium comes with low state investment and high social extraction based on lineage, ethnicity, or religion (see review by Ellen Lust and Lise Rakner). In this context, governments’ incentives to transfer resources are also likely to vary with ethnic demography.

[1] Pavithra Suryanaryan devoted multiple posts to discuss scholarship at the nexus of identity and state capacity. Giuliana Pardelli reviews her research that links contemporary ethnic demography to state capacity. Mohammad Saleh discusses“identity tax,” used by rulers to push the unwanted population to endorse the identity of the ruling group. Yuhua Wang considers how the structure of kinship networks affects state development by changing incentives to invest in centralized state institutions. In an earlier post, I examine how scholars have operationalized informational capacity in historical research.

[2] See ungated version at this link.

[3] This was the case, for example, in Stavropol, Buguruslan, and Novouzensk districts.

[4] The intuition is that age distributions follow a smooth curve, whereas errors in the age data reported in a census tend to produce “heaping” on specific numbers, typically those ending on the focal digits 0 and 5.

[5] Buguruslan. 1892. Zhurnal XXVII ocherednogo Buguruslanskogo Zemskogo Sobraniia. Buguruslan: Tipografiia Serebriakova, p. 21.

[6] Stavropol’. 1893. Postanovleniia ekstrennykh i ocherednogo Stavropol’skogo Uezdnogo Zemskogo Sobrania. Samara: Zemskaia Tipografiia, pp. 20, 97.

[7] Robbins, Richard G. 1975, Famine in Russia, 1891–1892: The Imperial Government Responds to a Crisis. New York, N.Y.: Columbia University Press, p. 52.